Topics and Markets Q4/2023

New year, old challenges

![[Translate to French:] Dr._Goetz_Albert](/fileadmin/_processed_/9/e/csm_Dr._Goetz_Albert_1_b75c5b90f5.jpg)

Despite all the crises, the difficult stock market year 2023 ended on a positive note. The DAX rose by a good 20% and the S&P 500 by more than 26%. However, it is questionable whether the interest rate cut rally on the stock markets will continue in the new year, as the economic situation remains difficult. Economic growth - at least in Europe - is more than meagre and geopolitical uncertainties have not diminished, on the contrary. However, leaving the stock market is of course not an option. Investors should diversify their portfolio with attractive, alternative investment strategies.

Yours,

Dr. Götz Albert

Partner and Chief Investment Officer

Back on the growth track

The European stock market is currently experiencing a remarkable development: After an unusually long period of weakness - with the horror year of 2022 and the first ten months of 2023 - European small & mid caps now appear to be reversing the trend towards their long-term upward trend. Since the low point at the end of October 2023, prices of European small & mid caps have recovered by a strong 18%.

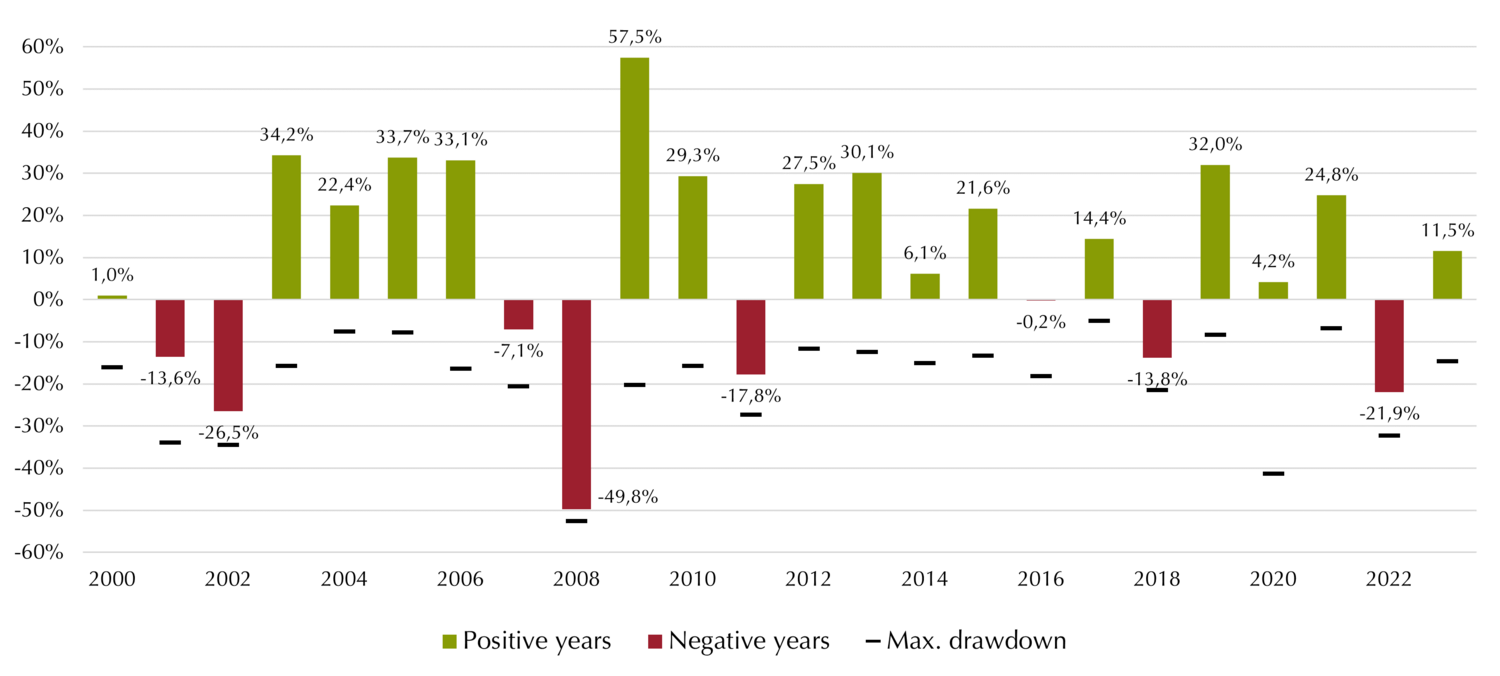

The recent developments make it clear that equity investors, particularly in the small & mid cap segment, should have stamina despite interim drawdowns. A look at historical share price performance also shows that such periods do not necessarily have to end with negative annual results. While the return on European small & mid caps was still in negative territory until the end of October, the segment has now recorded an increase of over 11% for the year as a whole. The chart below underlines that this is not an isolated case in history: Year-end values rarely fall to the lowest level of the year as a whole; 2020 was also an impressive example of this. So, if investors remain prudent, they can avoid selling at such low points which would be the worst possible scenario for them.

Instead, long-term investors should view the inevitable setbacks on the stock markets as favorable buying opportunities and as opportunities for future gains. Irrespective of short-term, tactical opportunities, small & mid caps have earned a permanent place in investors’ strategic asset allocations, as they can make a significant contribution to the overall performance of the portfolio despite temporary volatility. After the past difficult years for small caps, they now appear to be back on their long-term growth path.

Marcus

Ratz

Partner, Portfolio Management Small & Mid Caps Europe

Increasing momentum in the primary market

The convertible bond market is currently experiencing a renaissance. The rise in interest rates last year led to increased issuance and thus to a noticeable revival of the market, making this form of investment increasingly attractive again for both issuers and investors.

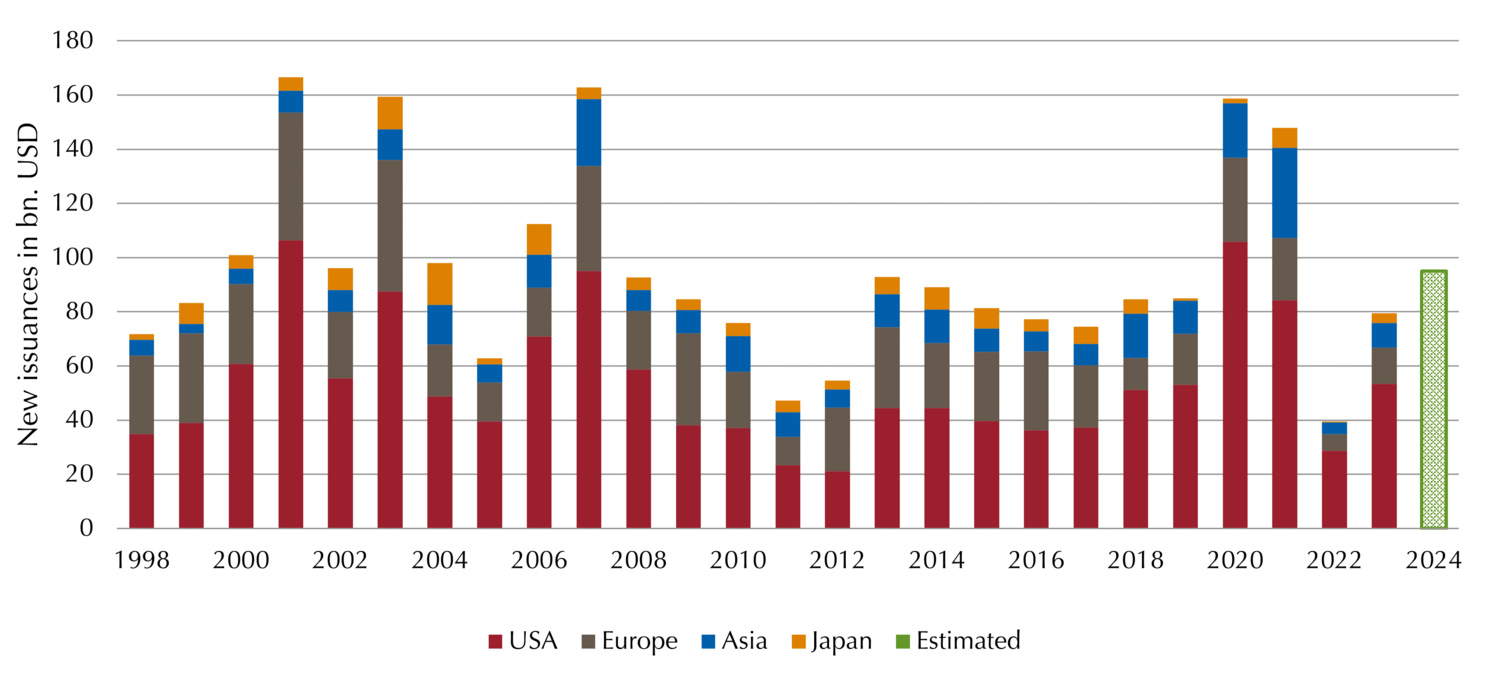

The increase in primary market activity in the fourth quarter, especially in November, was particularly noticeable and was significantly higher than in the previous year. This development can be partly explained by the so-called "maturity wall" in the convertible bond and high-yield bond segments. Due to necessary refinancings, expectations for the primary market in 2024 are high and issuance actitivity is likely to increase further in the following two years, which indicates continued momentum in this segment (see chart).

This development opens interesting investment opportunities for investors in the convertible bond market. Among the new issues in the fourth quarter of 2023 were securities from well-known companies such as Bechtle, RAG/Evonik, Sibanye Stillwater, Uber, Rivian, Ubisoft and Schneider Electric as well as various Japanese companies such as Sanrio, Sosei and Kobe Steel. It is noteworthy that not only growth and technology companies are entering the market, but also many from the utilities, industrial and cyclical consumer sectors. This expansion of the universe enables broader diversification within the asset class.

Another advantage for investors is the so-called new issuance premium which averages 1% on the day of issuance but is sometimes significantly higher. In addition, the increased activity in the primary market also promotes liquidity in the secondary market, which is an advantage for both new and existing convertible bonds. Overall, this results in an extremely attractive environment for investors, characterized by greater diversification, attractive new issues and improved liquidity.

Marc-Alexander

Knieß

Portfolio Management Global Convertible Bonds

Stefan

Schauer

Portfolio Management Global Convertible Bonds

Manuel

Zell

CESGA, Portfolio Management Global Convertible Bonds

Attractive real returns with manageable risks

Following the end of interest rate hikes, many market participants are expecting the first interest rate cuts in the course of the new year. However, inflation and interest rates remain at a higher plateau than in previous years - a sign that the days of ultra-low interest rates are over for the time being.

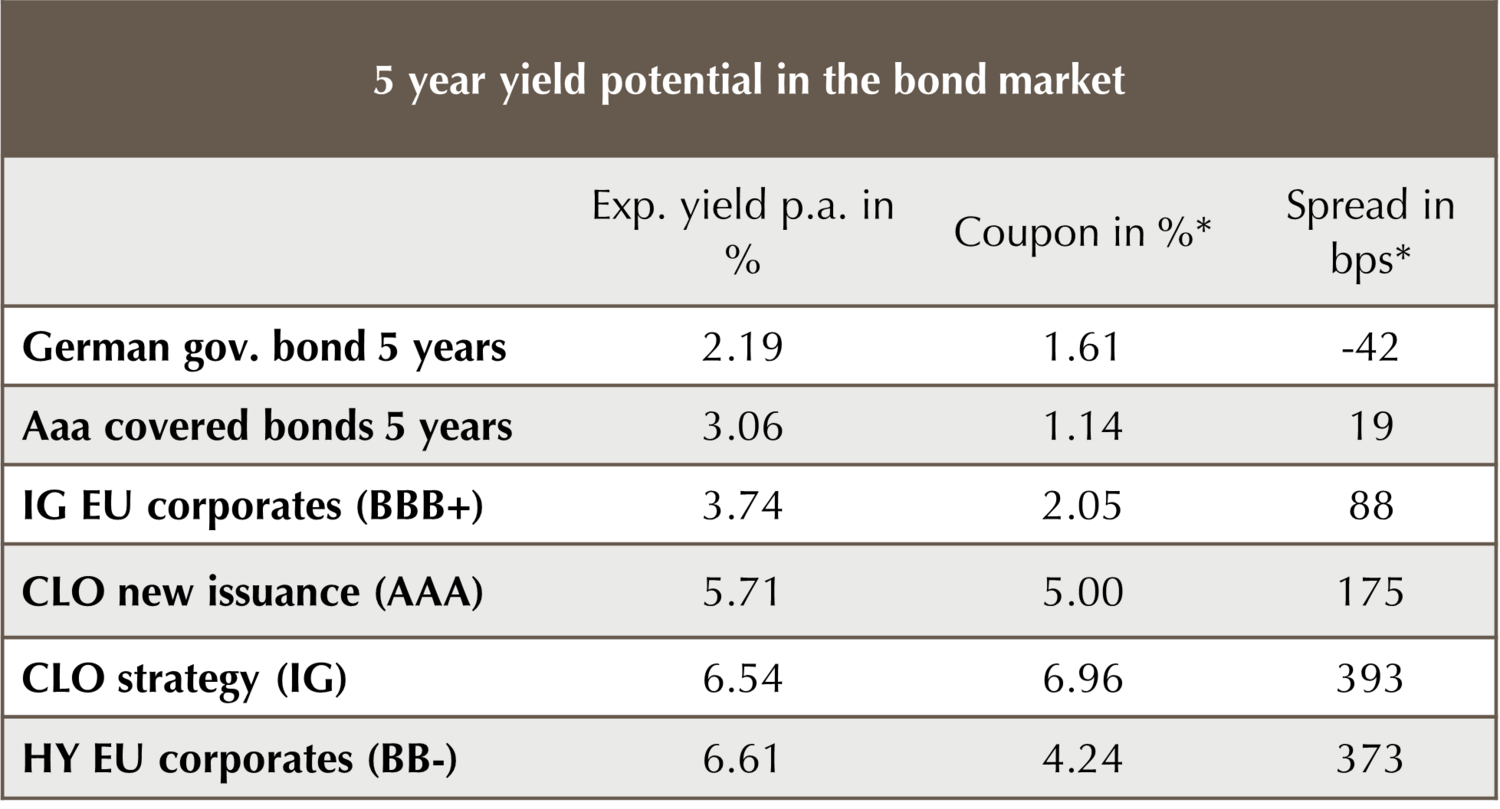

Although classical bonds are once again offering positive nominal yields, the joy is overshadowed by high inflation. With inflation rates averaging 3.2% over the last five years, real yields on government bonds have been a non-starter. Even under the optimistic assumption of an inflation rate of 2.25% over the next five years, the segment remains a far way from generating an adequate real return, let alone making a significant contribution to capital accumulation. In addition, the persistently low coupon level - a relic of the low interest rate policy - makes it difficult to generate predictable income streams.

Investors looking to generate real returns in the bond segment are therefore forced to turn their attention to higher-risk corporate and high-yield bonds. However, with a potential recession looming, this is not an appealing option, as higher gross yields offer poor comfort should defaults occur.

This is where CLOs come into their own, as they offer attractive real returns with manageable risks even in difficult economic times. For a euro investment grade CLO strategy, for example, we forecast an annual return of 6-7% p.a. in the medium term. Three main drivers are strengthening investor confidence in this strategy: Firstly, the higher coupons due to higher market interest rates, even for issuers with high credit ratings. Secondly, the higher coupons due to attractive credit spreads in a long-term comparison. Thirdly, the "pull-to-par" effect results in further price potential, as the prices of CLOs and their underlying loans continue to trade below par.

Dr.

Klaus

Ripper

Portfolio Management Fixed Income Credit

Norbert

Adam

Portfolio Management Fixed Income Credit

Current yield expectations higher than ever before

Volatility strategies closed 2023 with an outstanding performance and very low volatility, underlining their positive contribution to a portfolio's overall return.

Volatility is one of the most established and stable alternative risk premia that has been observed in the liquid space for more than 30 years. A clear and comprehensible mechanism, which is similar to a classic insurance policy, enables a very attractive risk premium to be collected in absolute and risk-adjusted terms.

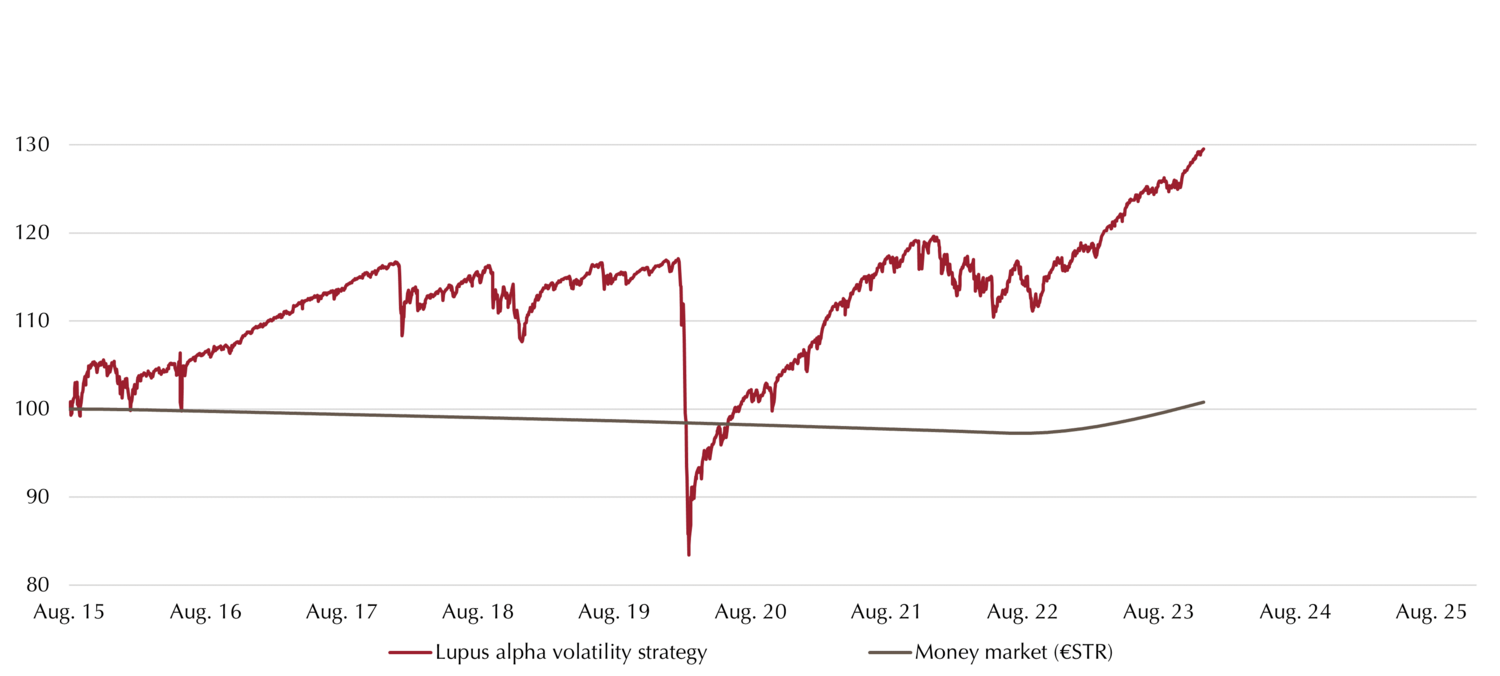

Since the sharp drawdown in 2020, volatility strategies have shown an impressive performance (see chart). Even the end of the low interest rate phase last year has not affected this positive development, on the contrary. The key to this success lies in the high volatility risk premium ("VRP"), driven by increased demand for hedging. Interestingly, many providers of insurance disappeared from the market after the coronavirus pandemic, opening up additional opportunities for the remaining investors in volatility strategies.

Currently, the medium-term total return expectation for volatility strategies is higher than ever before. But why is that? For one thing, the VRP remains at a high level. Even if it declines from the record levels after the Covid crisis, it remains higher than before the pandemic for the structural reasons mentioned above. On the other hand, volatility strategies are implemented using derivatives, based on a portfolio of short-term bonds with good credit ratings. As interest rates have risen, the expected return from the underlying portfolio has also increased.

This results in an impressive absolute return expectation of 8.0 to 8.5% in total, which is made up of around 3.5% (money market) interest and 5.0% risk premium. These figures show once again why volatility strategies should have a permanent place in every portfolio.

Mark

Ritter

CFA, CAIA, Portfolio Management Derivative Solutions

Alexander

Raviol

Partner, CIO Derivative Solutions

Intelligent combination of security and performance participation

When constructing a portfolio, investors have always been faced with the question of finding the right balance between expected risk and expected return. While many investors - rightly - relied on a high equity allocation in times of zero interest rate policy, this was associated with substantial, temporary losses due to the crisis. The horror year of 2022 showed that traditional diversification through bonds does not offer safety at any times, as bonds also suffered heavy price losses.

So are investors with return expectations above the inflation rate at the mercy of fluctuations on the equity and bond markets? Do they have to believe in the promises of so-called "crash prophets" to avoid high drawdowns, who, in the past, may have cushioned losses but have not been able to generate any significant returns in normal market phases? No. Intelligent, option-based capital protection strategies can preserve participation opportunities while limiting drawdowns at the same time.

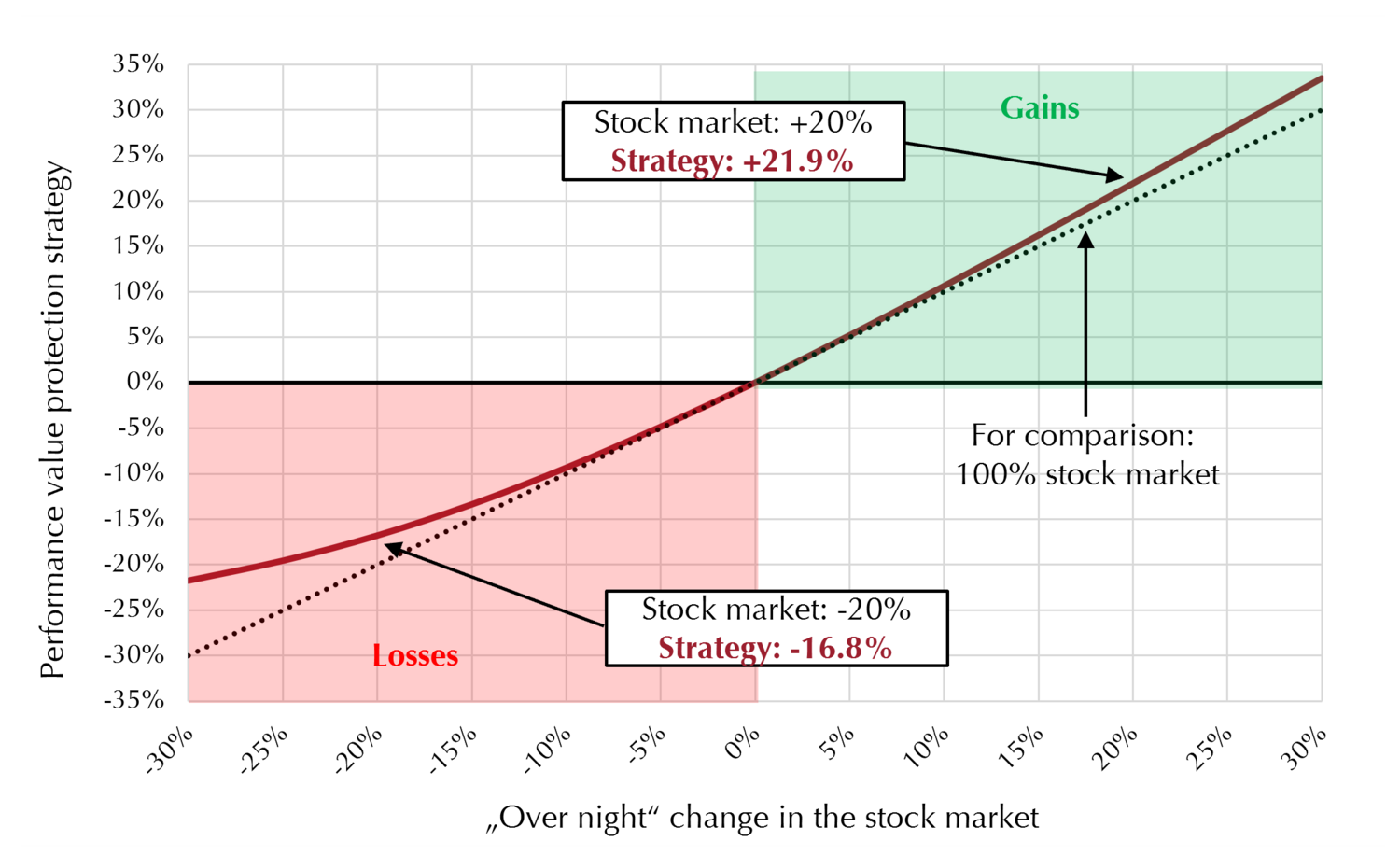

The risk/reward ratio of capital protection concepts can be adapted to the investor's individual risk appetite. Depending on the equity market delta, both, conservative profiles (with strong loss avoidance and moderate market participation) and more aggressive approaches (with a moderate risk of losses and higher performance participation) can be reproduced. The chart below shows an example of stock market performance and an option-based value protection strategy under the assumption of an overnight shock.

Specifically, the use of options makes it possible to manage potential losses ex ante without taking the risk to end up in a so-called "cash lock". In the worst-case scenario, it is only the purchased call options that expire worthless. At the same time, the use of options across different maturities and strike prices offers the opportunity to participate in gains on the global equity markets, which just recently was impressively achieved in the 2023 year-end rally.

Stephan

Steiger

CFA, CAIA, Portfolio Management Derivative Solutions

Alexander

Raviol

Partner, CIO Derivative Solutions

Sensitivity required

In contrast to the rush in 2022, overlay managers enjoyed a quite calm year in 2023. Nevertheless, the past year has also shown that it is wise to think outside the box and view the portfolio, including all sub-segments, as one big puzzle whose pieces fit together.

But how do you identify the risks in a portfolio that are suitable for an overlay? The first step is a detailed analysis of the asset allocation. This is done using benchmarks provided by the investor. Interestingly, it is not necessary to transmit individual positions. Instead, the portfolio is analyzed according to various criteria: The focus is on asset classes, countries, regions and sectors. It is like a geographical grid that is placed over the investment spectrum in order to uncover hidden risks.

Once this analysis has been completed, the proportion of the portfolio that can be hedged is determined. This is done by identifying the underlying risk and the relevant risk drivers. Appropriate hedging positions are then built up for the areas of the portfolio that can be hedged. It is crucial to choose the right hedging mechanisms and determine their intensity appropriately - almost like balancing a sailing boat in stormy seas.

But what happens to the risk classes that cannot be hedged? These risks are either monitored closely or a portion of the risk budget is reserved for them. If possible, so-called "proxy hedges" may be used. In any case, it is important to always keep an eye on all risks.

Overall, 2023 proves that a smart, holistic approach and careful handling of risks are key in overlay management. It is a complex game with many variables that requires a sure instinct, deep knowledge and foresight.

Marvin

Labod

Head of Quantitative Analysis

Alexander

Raviol

Partner, CIO Derivative Solutions