Market update CLO April 2023

Performance Review 2023

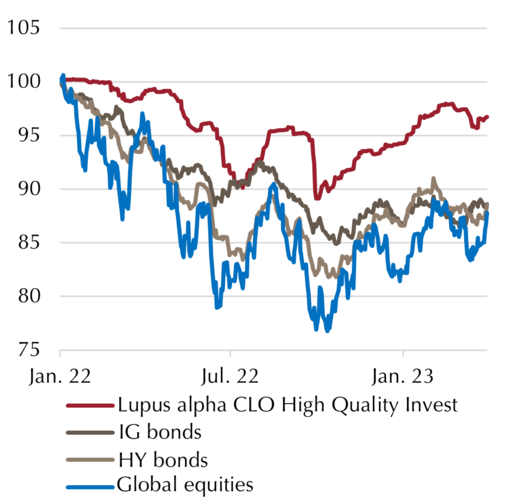

For many investors, 2022 was more than challenging. The mix of geopolitical uncertainties, high inflation, rising interest rates and recession fears caused losses across the board (with the exception of some commodities). Even supposedly defensive portfolios with a high bond allocation came under massive pressure as interest rates rose. Many investors could hardly have imagined such losses on bonds - especially those with high credit ratings. This also called into question asset allocation theories that were believed to be safe: Even the classic 60/40 portfolio lost more than -20% at times (-16.2% at the end of the year), with bonds performing only slightly better than equities and thus offering hardly any diversification effects.

Performance since 2022

Lower interest rate risk from CLO

These enormous price losses are to a large extent a consequence of the strong dependence of fixed-interest securities on interest rates. If the general interest rate level rises, the low coupons (from times of low interest rate policy) become less attractive. Accordingly, bonds with longer remaining maturities are more affected by such interest rate developments. By contrast, the shorter the remaining term, the less bonds suffer from this duration effect. This is most evident in the case of floating-rate products: In the case of CLOs, for example, the market interest rate adjusts to the current level of Euribor every three months. As a result, interest-rate-induced losses were relatively low last year: Our Lupus alpha CLO High Quality Invest fund ended 2022 with a relatively moderate loss of -5.7%.1 Bonds (both with high credit ratings and those from the high yield segment), on the other hand, lost more than -13% - with even greater drawdowns during the year. In addition, CLOs benefited from the rise in interest rates as the year progressed. Since the low in the fall of last year, our CLO fund has already gained a strong 8.6%.

1 Return of 0,94% p.a. since inception (01.07.2015), Volatility of 4,26% p.a. since inception (per 31.3.2023). Past performance is no guarantee for future performance. This can be higher as well as lower.

Alternative for the current market situation

Especially in the current market phase, this characteristic is a strong argument for CLOs: Almost every day, statements by central bankers and the market's interest rate expectations determine price movements. If you want to be less dependent on these factors, CLOs are a suitable component for your asset allocation. This is also underlined by the relatively low volatility of CLOs in 2022, a year characterized by turbulence.

In addition, the increasing recession concerns hardly play a role for CLOs, which is mainly due to their structure: Due to their waterfall structure, CLOs with high credit ratings offer a high degree of security even in times of a weaker economy. If credit defaults actually occur, investment grade CLOs are hardly affected, as losses are first absorbed by the subordinated equity and then the mezzanine tranches. The actual credit/default risks are therefore particularly low for CLOs with investment grade ratings: securities in this segment have recorded a cumulative default rate of just 0.09% over the past 5 years.

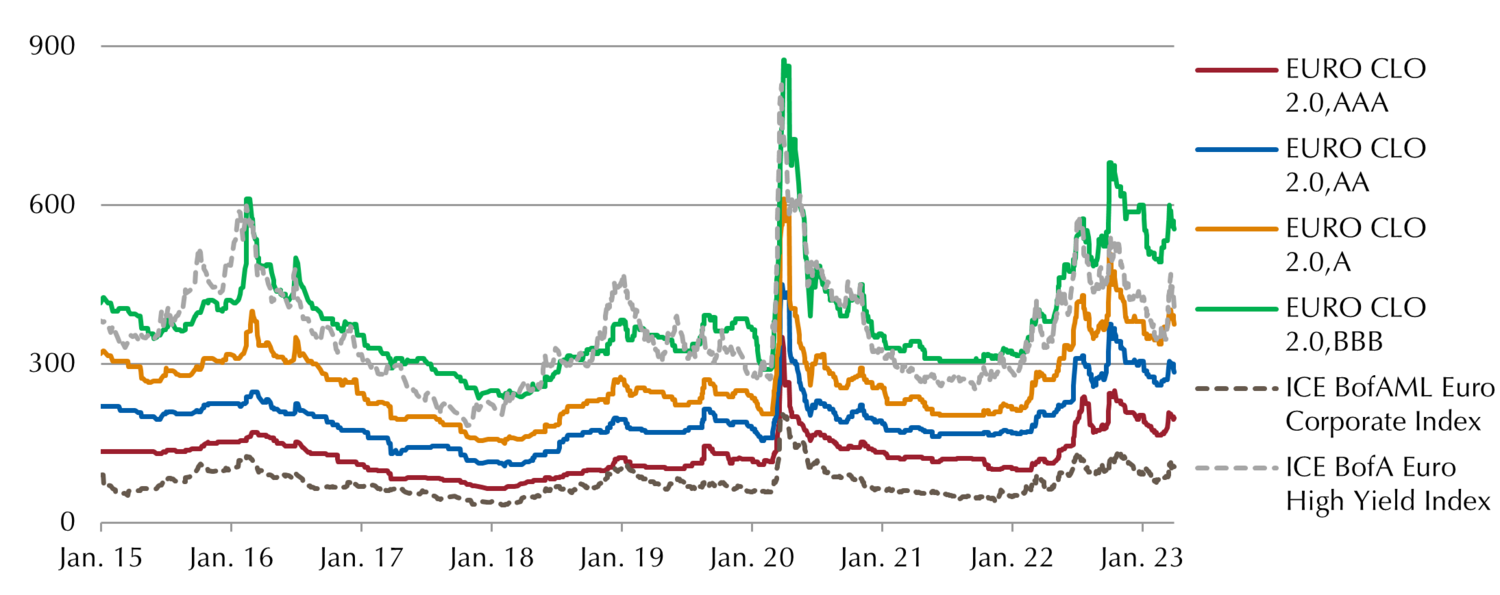

Structural yield differences

Interestingly, despite the lower risks, CLOs offer structurally higher yields than corporate bonds (see chart below). For example, even the spreads for European CLOs with the highest credit rating (AAA) are structurally significantly higher than the spreads for investment grade corporate bonds (AAA to BBB-). Fundamentally, this is difficult to justify. It can be assumed that this reflects a kind of "complexity premium". Unlike bonds, CLOs are less well known and more difficult to analyze. However, with our Structured Credit team at Lupus alpha, we specialize in exactly this and are therefore able to leverage the potential available.

Structural spread differences

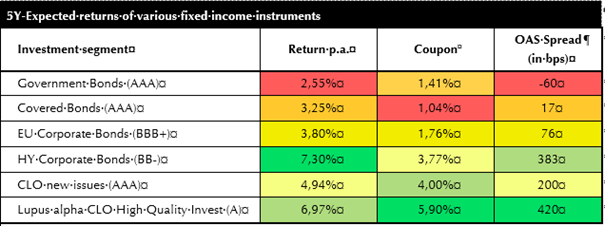

Current opportunities

However, CLOs not only have a structurally more attractive risk-return profile than bonds, but are also likely to be of interest to investors, especially in the current market phase: Although classic bonds are again offering positive nominal interest rates after years of zero interest rate policy, the real yield on papers with high credit ratings (e.g. government and covered bonds) is still negative due to high inflation rates. Even if we take market expectations of 2.5% inflation for the next 5 years as a basis - which in our view is a thoroughly optimistic assumption - this segment offers no significant real return and thus hardly any potential for capital preservation (let alone asset accumulation). Moreover, it is difficult to generate predictable, ongoing income streams, as the bonds still have low coupons from times of low interest rates.

So, in order to generate real returns in the bond segment, investors have to invest in riskier corporate and high-yield bonds, which is not a real alternative for many investors, especially in the face of an impending recession. Should defaults occur here, the higher "gross yields" in this area are little consolation.

CLO, on the other hand, offer attractive real returns with manageable risks even in an economically challenging environment. The expected return for our Lupus alpha High Quality Invest from the investment grade segment is 6-7% annually over the medium term.² We see three main drivers for this:

(1) Rising coupons due to increased market interest rates (also for issuers with high credit ratings).

(2) Higher coupons due to widening credit spreads.

(3) The prices of CLOs or their underlying loans are trading well below par due to the moderate price losses last year, so that the "pull-to-par" effect offers further upside potential.

² Expected return based on 5Y forward swaps on Euribor.

Expected returns of various fixed income instruments

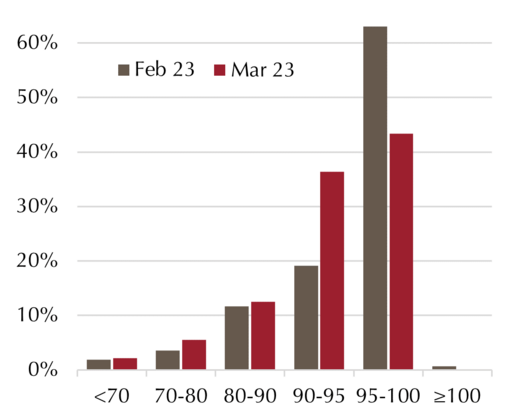

The latter can also be observed in the distribution of European loan prices. The chart below clearly shows that the turbulence in the banking market has also put loan prices under renewed pressure and thus continues to offer high catch-up potential. The fact that this potential is not associated with higher default risks is not least due to the aforementioned waterfall structure of CLO.

Distribution of loan prices

___________________________________________________________________________________________________________________________________

Chances

Provides access to the European corporate loan market.

Combines the performance potential of corporate loans with high default protections ( investment grade segment).

By buying loans indirectly via CLOs, one can create a liquid portfolio that meets the requirements set out by UCITS and VAG.

Low dependency to general interest rate trends.

Decent yield through ongoing coupon payment in the portfolio

Risks

Counterparty default risk: If counterparties and issuers do not fulfill or only partially fulfill their contractual payment obligations, this can result in losses for the fund. Even when securities are carefully selected, losses caused by the financial collapse of issuers cannot be ruled out.

Concentration risk: If investment is concentrated on particular assets or markets, the fund becomes particularly heavily dependent on the performance of these assets or markets.

Operational risk: The fund can become the victim of fraud, criminal acts or errors by company employees or external third parties. Finally, management of the fund can be negatively impacted by external events such as fires, natural disasters or similar.

Liquidity risk: If securities are traded in a relatively narrow market segment, it can be difficult to resell them in situations where there is insufficient liquidity.

Interest-rate risk: Changes in market interest rates can affect the prices of fixed-income securities. These fluctuations vary, however, depending on the term of the fixed-income securities.

Market Risk: The performance of financial products depends on the development of the capital markets.

For detailed information on opportunities and risks, please refer to the current sales prospectus.

Disclaimer: This fund information is provided for general information purposes only. This information is not designed to replace the investor‘s own market research, financial analysis, nor any other legal, tax or financial information or advice. The information presented does not constitute in any manner a solicitation activity, an invitation to buy or sell, nor an ancillary investment service such as investment research or financial analysis within the meaning of Section B(5) of Annex II, nor does it qualify as investment advice within the meaning of Section A(5) of Annex I of MiFID II (as it does not amount to an objective and independent explanation of a recommendation within the meaning of article 36,1.a) of the Delegated Regulation (EU) 2017/565 of 25 April 2016) and should not be treated by recipients as such. It does not contain any key information enabling to make important economic decisions and may differ from information and estimates provided by other sources or market participants. We accept no liability for the accuracy, completeness or topicality of this information. All statements are based on our assessment of the present legal and tax situation. All opinions reflect the current views of the portfolio manager and can be changed without prior notice. Full details of our funds and their licenses of distribution can be found in the relevant current sales prospectus and, where appropriate, Key Information Document, supplemented by the latest audited annual report and/or half-year report. The relevant sales prospectus and Key Information Documents prepared in German are the sole legally-binding basis for the purchase of funds managed by Lupus alpha Investment GmbH. You can obtain these documents free of charge from Lupus alpha Investment GmbH, P.O. Box 1112 62, 60047 Frankfurt am Main, Germany, upon request by calling +49 69 365058-7000, by e-mailing info@lupusalpha.de or via our website www.lupusalpha.de. If funds are licensed for distribution in Austria the respective sales prospectus, Key Information Document and the latest audited annual report or half-year report are available from the Austrian paying and information agent UniCredit Bank Austria AG based in Rothschildplatz 1, 1020 Vienna, Austria. Fund units can be obtained from banks, savings banks and independent financial advisors.

This document is directed at professional investors only. Therefore, neither this document nor the information made available thereon shall be construed as a distribution in or from France to any person other than professional.

Neither this fund information nor its contents or a copy thereof may be amended, reproduced or transmitted to third parties in any way without the prior written consent of Lupus alpha Investment GmbH. By accepting this document, you declare your consent to comply with the aforementioned provisions. Subject to change without notice.

Lupus alpha Investment GmbH

Speicherstraße 49–51

D-60327 Frankfurt am Main