![[Translate to French:] Absolute Return Studie [Translate to French:] Absolute Return Studie](/fileadmin/_processed_/7/1/csm_Vola-Studie_8039834ee7.jpg)

Interest rate reversal dampens regulated hedge funds – highest outflows since 2008 despite strong performance

Hedge fund strategies in the UCITS format were severely affected by the market distortions after the interest rate reversal in 2023. Net outflows from this asset class reached €17.65 billion in 2022 and €35.1 billion in 2023. To put this into perspective: In July 2022, after more than six years, the ECB raised interest rates from 0% to 0.5%. Since September 2023, the ECB key interest rate has remained at 4.5% after nine further steps. Initially, the prices of safe Euro government bonds fell by almost 20% as a result of the massive rise in interest rates. However, with the return of interest rates, investors quickly and decisively turned to the interest rate market. This led to a massive reallocation, which also left its mark on the investment strategies analysed. In the first quarter of 2023, the Deutsche Bundesbank reported “historically high shifts” to fixed-interest investments, a trend that accelerated later in the year.

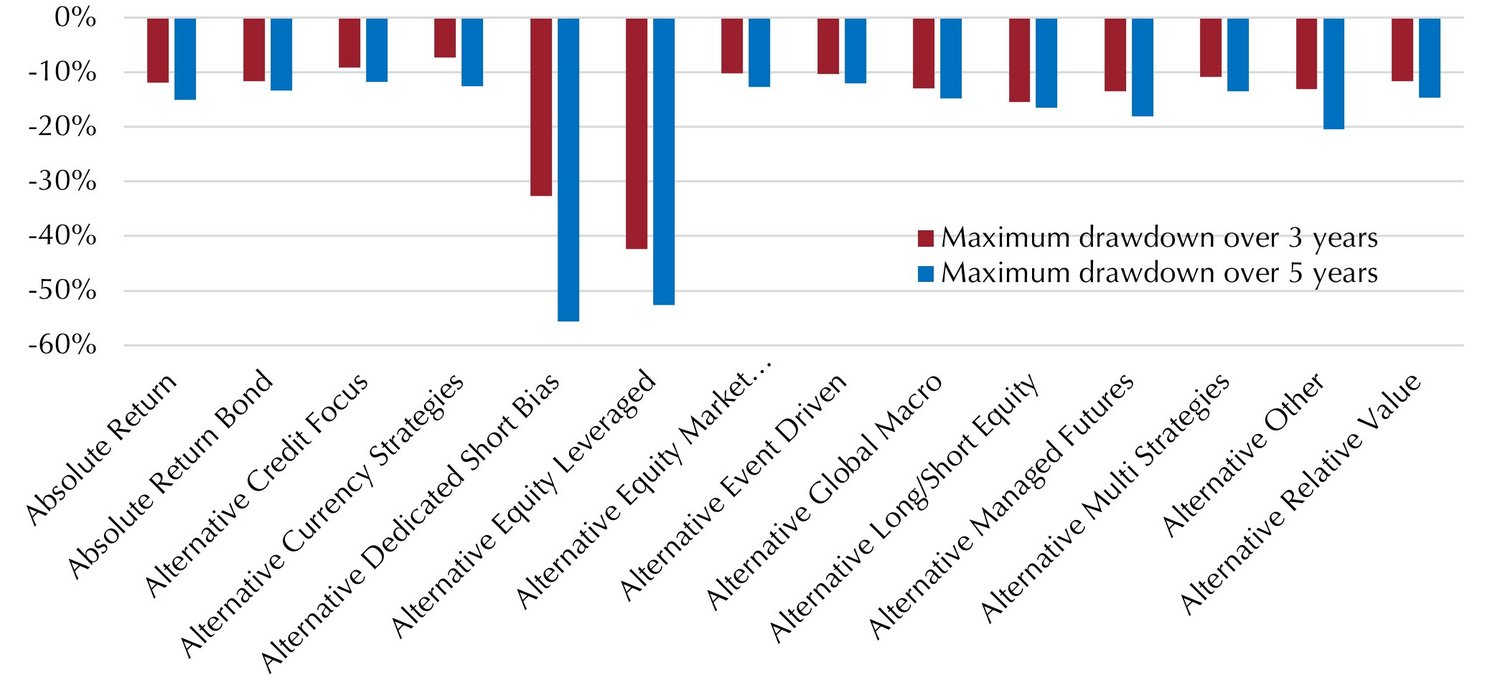

In keeping with this new interest rate environment, nearly 40% of gross inflows into liquid alternatives were attributable to the only two fixed-income strategies in the segment: Alternative Credit Focus and Absolute Return Bond. However, the key to a high return in 2023 was in the equity market, with Liquid Alternatives clearly lagging behind with an average performance of 5.28%. Focusing purely on performance, however, does not take into account their stabilising contribution to the overall portfolio. This is evidenced by the medium and long-term perspective. In the disastrous investment year of 2022, when equities and bonds fell simultaneously, Liquid Alternatives stabilised their investors’ portfolio returns, while bonds viewed over three and five years are still chasing their losses today. The same applies to volatility and maximum drawdowns. Here too, Liquid Alternatives show their strengths: Over five years, their average maximum drawdown was 17.9%, compared with 25.3% for the Euro Stoxx 50 (on a monthly basis).

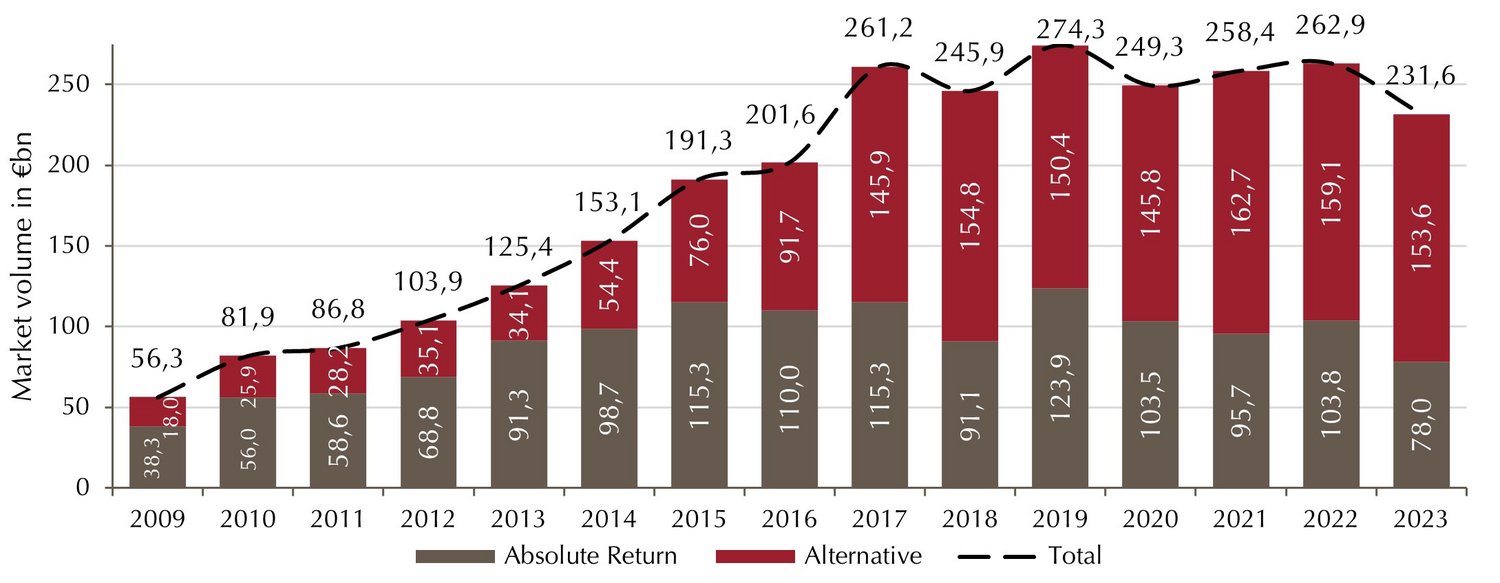

Interest rate reversal leads to significant decline in market volume

While the number of funds in the analysed sector remained largely constant, these funds had to cope with significant outflows. The main reason for this is the reallocation of investor funds towards interest-bearing investments, which has been implemented since the interest rate reversal in July 2022. Including a positive market effect, the market volume fell by almost 12% to €231.6 billion.

Significant decline in market volume

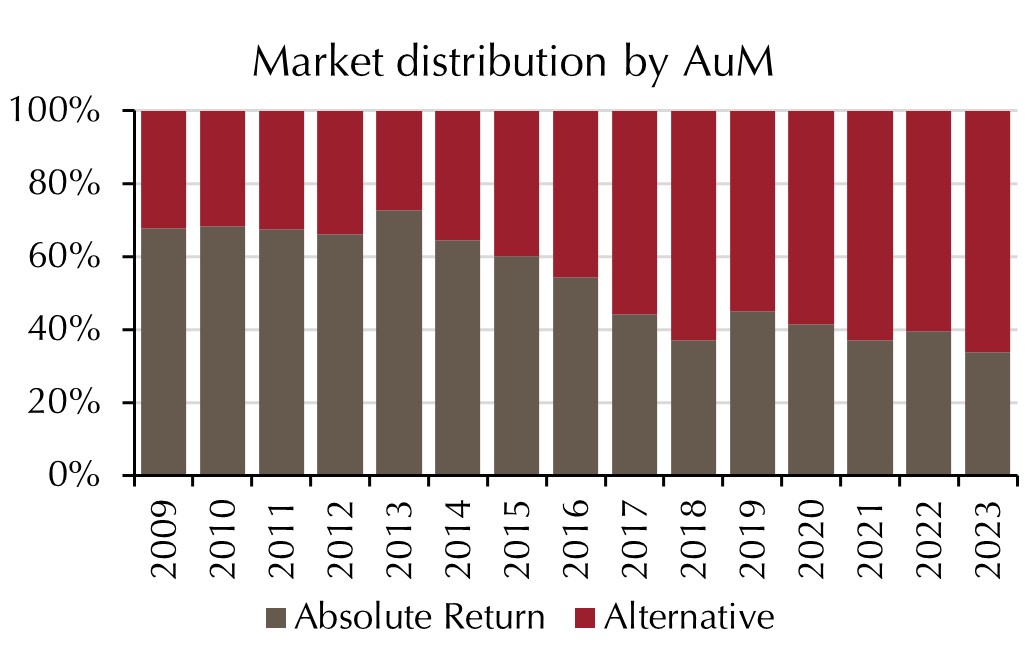

Net outflows amounted to €35.1 billion, the highest level in the past 15 years. Here too, investors’ are turning to alternative concepts, which lost only around € 5.5 billion (-3.5%), while absolute return funds experienced a notable decline of €25.8 billion (-24.8%). Both the number of funds and the market allocation by volume indicate that the Liquid Alternatives Strategies group has become increasingly dominant over Absolute Return over time, as illustrated by the following graphs:

Dominance of alternative strategies is growing steadily

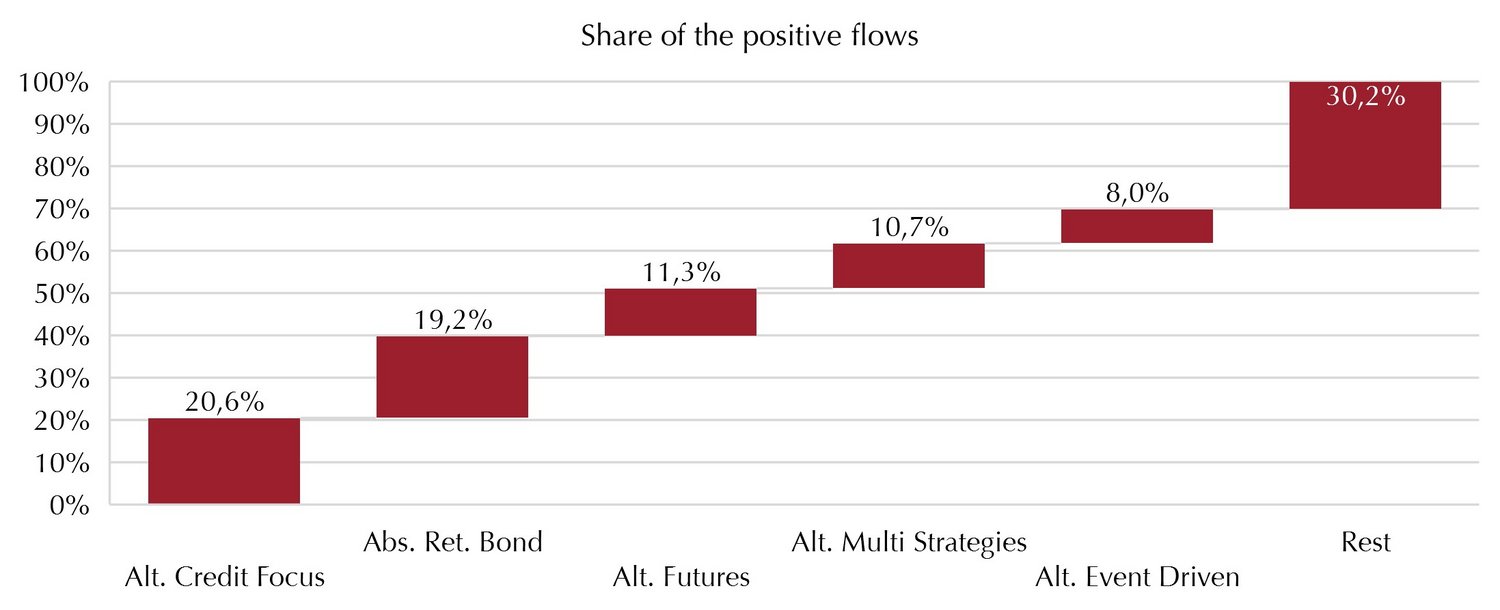

Positive fund flows mainly in fixed income strategies

Overall, more than a quarter (28.4%) of the funds have seen net positive fund flows despite the generally negative market environment for this asset class. The positive fund flows totalled €16.6 billion. It is striking that almost 40% of these inflows were attributable to the only two fixed income strategies in the segment: Alt. Credit focus (20.6%) and Absolute Return Bond (19.2%). A significant proportion of investors therefore also prefer fixed income strategies in this context. On balance, inflows were barely able to offset outflows (gross of €51.7 billion), resulting in net outflows of €35.1 billion.

Fixed income strategies attract investor funds

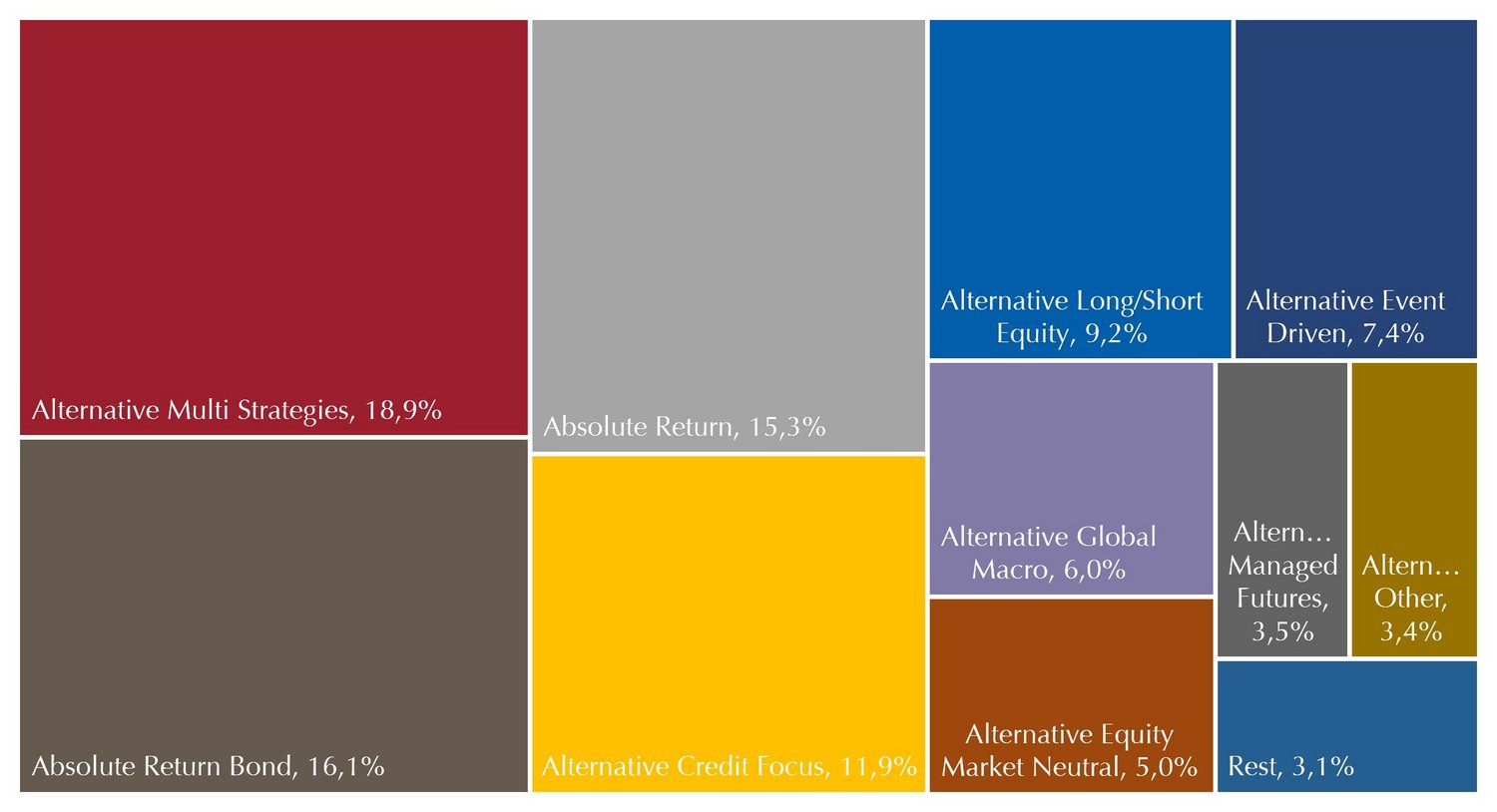

Fixed income strategies significantly increase market share

There is also a concentration in the allocation by strategy, with the three largest accounting for half of the market volume. The strongest change is shown by the previously leading Absolute Return strategy with a very significant drop of 6.6 percentage points. Alt. Multi Strategies came out on top with plus two percentage points. These multi-asset vehicles have been gaining in importance for years. Market shares also confirm the trend towards fixed income strategies: Together, Absolute Return Bond and Alt. Credit Focus account for more than a quarter of market volume after increases.

Absolute Return falls from first to third place

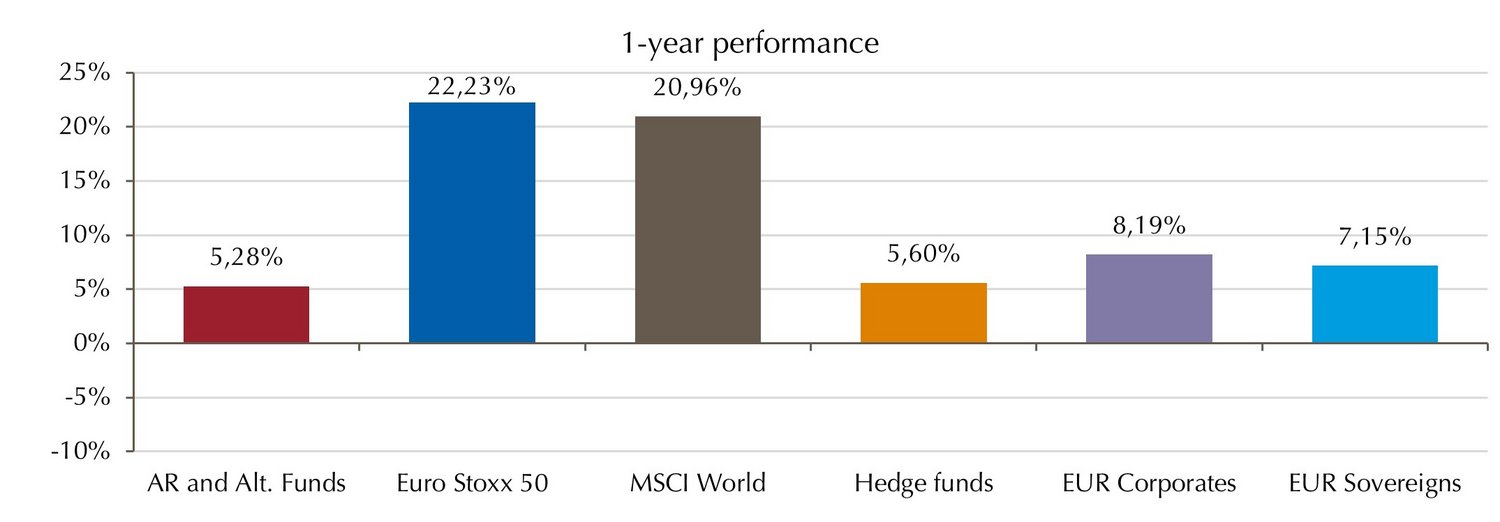

Liquid Alternatives underperform major asset classes in 2023

Liquid Alternatives delivered solid performance to their investors at an average of 5.28%, but lagged behind the large asset class. 2023 was a good year for equities, but government and corporate bonds also partially recovered their major losses after interest rate hikes. Unregulated hedge funds, by contrast, were almost on par with their regulated counterparts. Overall, around 80 per cent of UCITS hedge funds have a positive return. Only 24 of the funds recorded better returns than the Euro Stoxx 50 (3.8%). European corporate bonds outperformed 156 funds (22%).

Equities key to performance in 2023. Pensions are catching up.

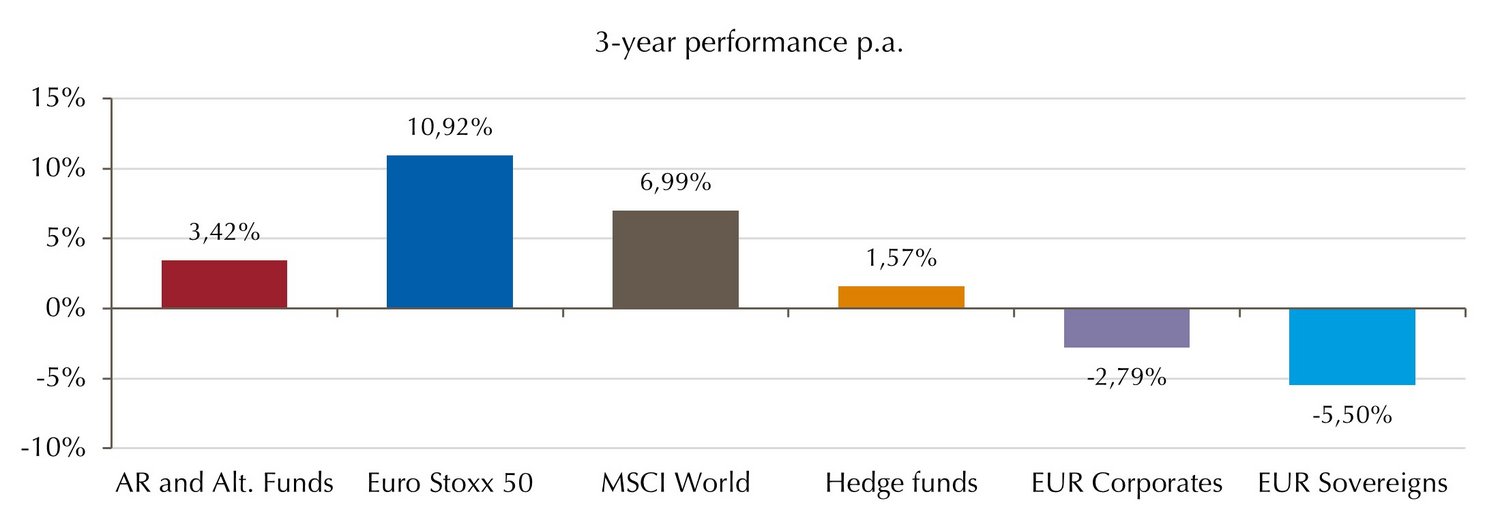

Liquid Alternative strategies position themselves in the long term between equities and bonds

Despite the strong bond performance in 2023, Liquid Alternatives significantly outperform the bond markets over three and five years, bonds are still processing the price losses after the 2022 interest rate reversal. Equities, on the other hand, have recovered their losses from 2022 at index level. Regulated hedge funds, with their diversifying properties, thus position themselves in the context of an overall portfolio between equities and bonds.

3 years: Liquid Alternatives with a solid return. Bonds still recording losses.

3 and 5 years: Stability anchor in the portfolio

In the medium and long term, the stabilising role of Liquid Alternative strategies is even clearer: Over five years, their average maximum drawdown was 17.9% (monthly basis). The Euro Stoxx 50 reached 25.3% and even Euro government bonds had to face regulated hedge fund strategies with a maximum loss of 21.3%.

3 and 5 years: Stability anchor in the portfolio

Glossar

| Absolute Return | Funds characterised by a highly regulated market environment and an absolute return target. They aim to add value in every market environment. They are usually measured against a risk-free or cash benchmark instead of a traditional long-only benchmark. |

| Absolute Return Bond | Funds that pursue positive return targets in all market situations and primarily invest in debt securities. Products with the words “Absolute Return” added to their name or investment objective may be included in this category. In this case, the benchmark is usually a risk-free or cash benchmark instead of a traditional long-only market index. |

| Alternative Credit Focus | Funds that invest in structured credit products and whose investment process is characterised by either fundamental credit analysis, quantitative approaches or (market) opportunities. |

| Alternative Currency Strategies | Funds that invest in global currencies to exploit arbitrage opportunities (carry, momentum, fundamental opportunities). They use short-dated money market instruments and derivatives to achieve their objectives. Funds that invest the majority of their assets in cryptocurrencies also fall into this category. |

| Alternative Dedicated Short Bias | Funds that maintain a net short profile on the market on an ongoing basis. This category also includes funds that exclusively take short positions. |

| Alternative Equity Market Neutral | Funds seeking to generate consistent returns regardless of market phases. The portfolio is also managed with a net market exposure of zero. |

| Alternative Event Driven | Funds that aim to exploit price inefficiencies caused by a business transaction (e.g. insolvency, acquisition, spinoff, etc.) in accordance with their sales prospectus. Event-driven funds can invest in a variety of instruments with different risk structures (e.g. equities, credit instruments, derivatives). |

| Alternative Global Macro | Funds that make global investment decisions based on economic theories. These strategies typically base their decisions on interest rate expectations, expectations concerning political developments, and other macroeconomic and systemic factors. Global macro funds typically use a wide range of instruments and investment universes to implement their investment ideas. |

| Alternative Long/Short Equity | This strategy uses both long and short positions in equities, equity options and equity index options. The portfolio manager can decide whether the net position of their fund is positive or negative depending on their market view. |

| Alternative Managed Futures | Funds that primarily invest in a portfolio of futures contracts and aim to generate positive returns that are independent from the market in any situation with limited volatility. Their investment approaches consist of proprietary trading strategies that can include both long and short positions. |

| Alternative Multi Strategy | Funds that aim to generate an overall return by managing several different hedging strategies. These funds typically follow a quantitative approach and seek to identify opportunities where there are changes to the long-term risk-adjusted relationship between two securities. |

| Alternative Relative Value | They use option and arbitrage strategies on highly correlated pairs of securities to exploit price differentials. In such cases, the funds sell the more expensive security (short position) while taking a long position in the relatively cheap security. |

| Alternative Equity Leveraged | Funds designed to generate more than 100% of the daily performance of a benchmark index. They use a customised combination of futures contracts, derivatives and leveraged products to achieve this. |

About the Study

Since 2008, Lupus alpha has been evaluating the universe of absolute return and alternative funds on the basis of data from LSEG Lipper (formerly Refinitiv). The Study covers UCITS-compliant funds with an active management approach that are authorised for distribution in Germany. The Study focuses on market size, development and composition, performance in the investment segment and individual strategies, as well as key risk figures. It evaluates the three levels of aggregation – the overall universe, strategies within the universe, and funds within the strategies – and distinguishes between 14 strategies. The Alt. Long/short equity strategy, for example, includes 102 funds.

About Lupus alpha

As an independent, owner-operated asset management company, Lupus alpha has been synonymous with innovative, specialised investment solutions for over 20 years. As one of Germany’s European small and mid-cap pioneers, Lupus alpha is one of the leading providers of volatility strategies as well as collateralised loan obligations (CLOs). The specialist product range is rounded off by global convertible strategies and risk overlay solutions for institutional portfolios. The Company manages a volume of more than €14.0 billion for institutional and wholesale investors. For further information, visit www.lupusalpha.de.

For further information visit www.lupusalpha.de.

Disclaimer: This document serves as a study for general information purposes and is not mandatory in accordance with investment law. The information presented does not constitute an invitation to buy or sell or investment advice. It does not contain all key information required to make important economic decisions and may differ from information and estimates provided by other sources, market participants or studies. We accept no liability for the accuracy, completeness or topicality of this study. All statements are based on our assessment of the present legal and tax situation. All opinions reflect the current views of the Company and can be changed without prior notice.

Lupus alpha Investment GmbH

Speicherstraße 49–51

D-60327 Frankfurt am Main