SUMMARY

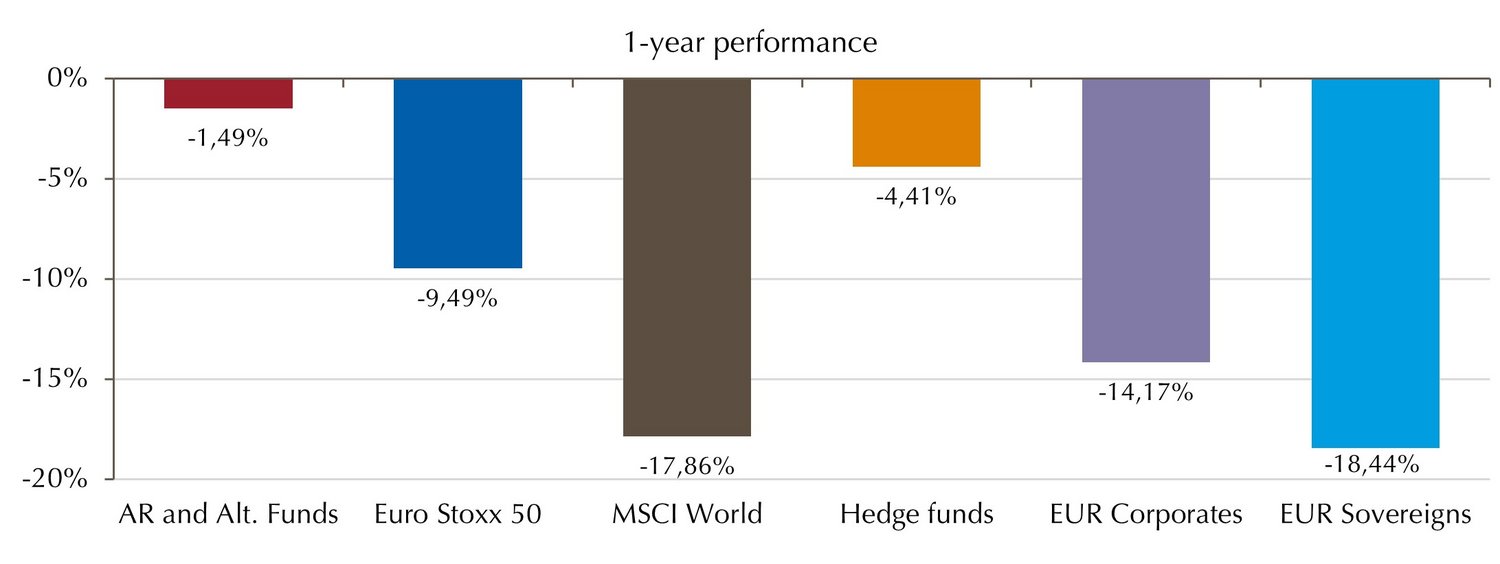

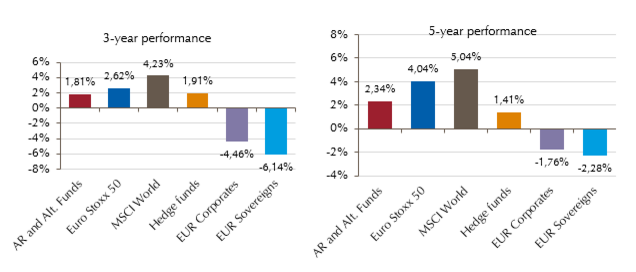

In 2022, liquid alternatives in Germany proved their worth in a challenging market environment, helping to diversify and limit losses in investor portfolios. Although they suffered slight losses with a performance of -1.49%, they fared considerably better than equities and bonds, and left unregulated hedge funds trailing in their wake. They also demonstrated their robustness in volatile markets with an average maximum loss of -10.38%.

Despite its comparatively strong performance in a difficult year for the capital markets, this investment segment recorded significant net outflows of EUR 17.56 billion. There are many different reasons for this. The rapid rise in interest rates and looming fears of a recession could be felt in fixed-income strategies in 2022, causing their market share to fall further, from roughly 40% as recently as 2020 to only around one-quarter of the market today. While short strategies that rely on declining markets delivered the best average performance over the full year, they were the weakest performers over five years and have lost more than a quarter of their investor funds over the past 12 months. The only strategy to record material net inflows of EUR 2.14 billion was Alt. Equity Market Neutral, which also made a positive contribution to returns.

The significant outflows in the evaluated class come as a surprise given its strong performance compared to equities and bonds. After all, liquid alternatives strategies made a significant contribution to diversifying portfolios and limiting losses at overall portfolio level amid a challenging market environment in 2022.